Unique Who Issues Accounting Standards For Non Corporate Entities

The scheme for applicability of Accounting Standards to Non.

Who issues accounting standards for non corporate entities. Revision in the criteria for classifying Level II non-corporate entities 1. - a The Institute of Chartered Accountants of India ICAI should not develop special accounting standards for small enterprisesnon corporate assesses. By Abdullah Karuthedakam - On May 1 2021 246 pm.

The Council at its 400th meeting held on March 18-19 2021 considered the matter relating to applicability of Accounting Standards issued by The Institute of Chartered Accountants of India ICAI to Non-company entities Enterprises. Level I as big entity whereas Level II entities and Level III entities are considered to be the Small and Medium Entities SMEs. LessorsCertain Leases with Variable Lease Payments Download July 2021.

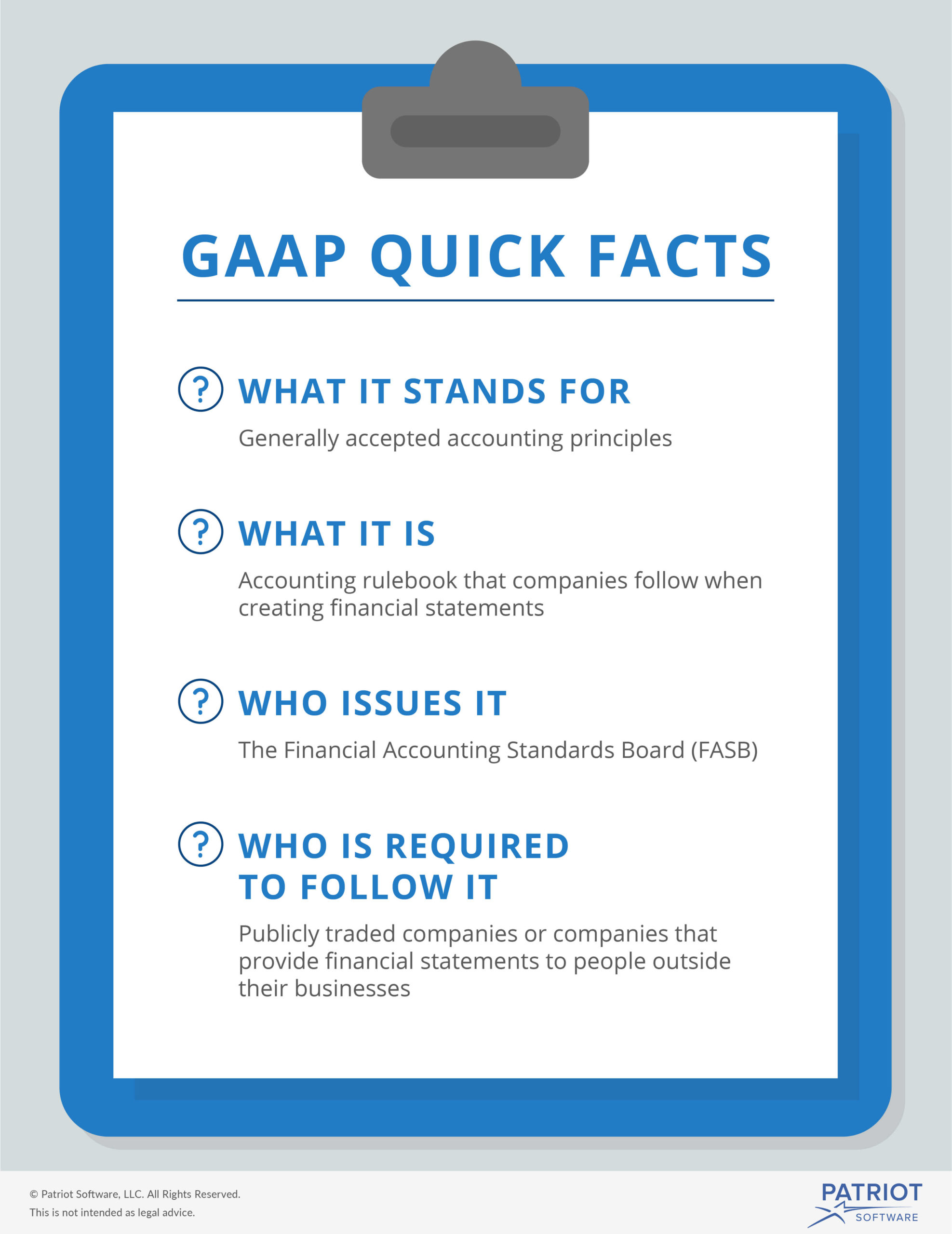

Amendments to Australian Accounting Standards Removal of Special Purpose Financial Statements for Certain For-Profit Private Sector Entities. Proprietorship firms Partnership Firms Trusts Societies LLP or any other entities. Entities to whom AS is applicable viz Companies to whom Companies Accounting Standards Rules 2006 is applicable and.

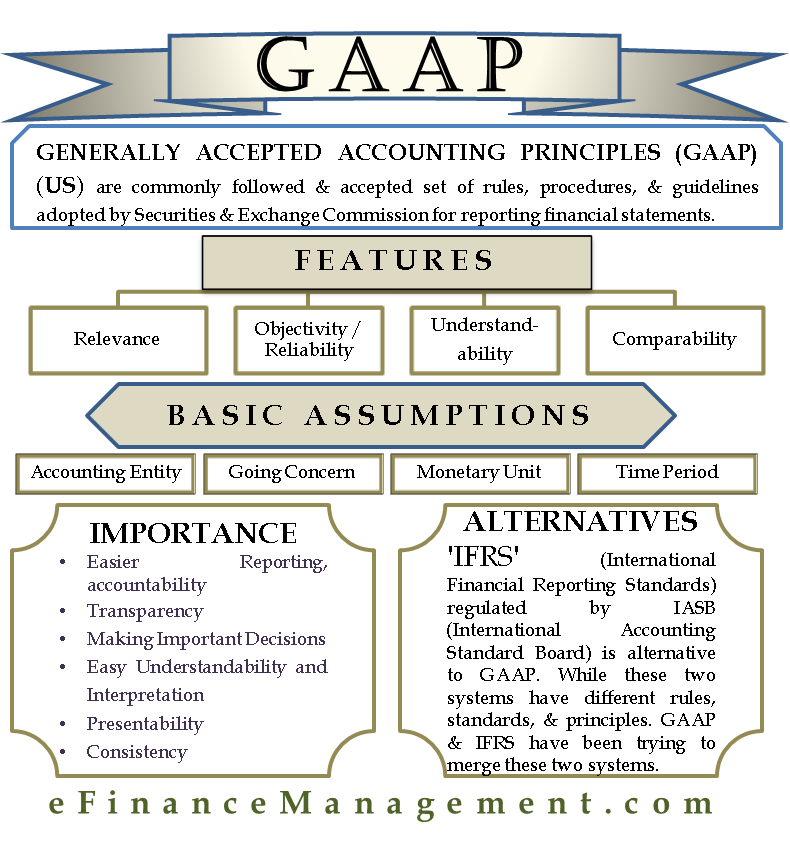

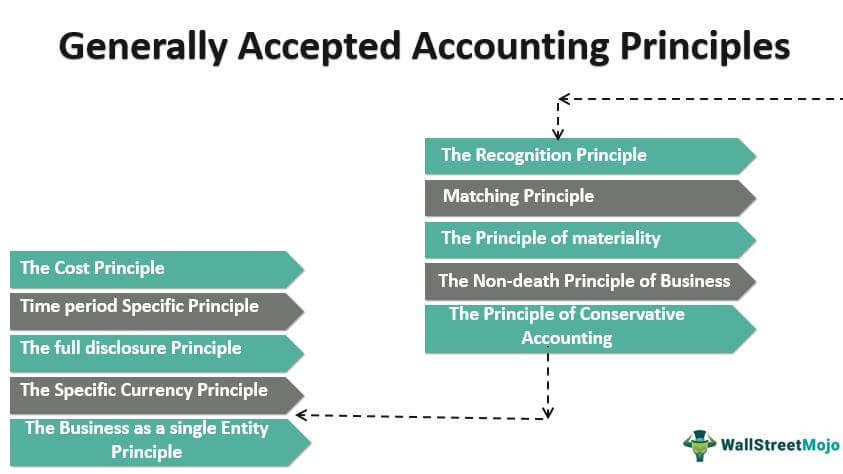

Since the issuance of ASU 2013-12 Definition of a Public Business EntityAn Addition to the Master Glossary the term public business entity PBE has been used to establish effective dates and to scale disclosure requirements for new ASUs. Accounting Standards ASs are written policy documents issued by expert accounting body or by government or other regulatory body covering the aspects of recognition measurement treatment presentation and disclosure of accounting transactions in the. The Accounting Standards issued by the ICAI are applicable for the entities other than companies and are aligned with Accounting Standards notified by the MCA with certain differences.

There are three levels of entities. Includes 1 public business entities as defined in the Accounting Standards Codification Master Glossary 2 not-for-profit entities that have issued or is a conduit bond obligor for securities that are traded listed or quoted on an exchange or an over-the-counter market and 3 employee benefit plans that file or furnish financial statements to the SEC. For applicability of Accounting Standards the ICAI in 2004 prescribed the criteria for classification of entities into level I.

The Council of the Institute with a view to harmonise the differences between the Accounting Standards issued by the ICAI and the Accounting Standards notified by the Central Government. Criteria for classification of Non-company entities for applicability of Accounting Standards. Therefore all companies need to consider whether or not they meet the definition of a PBE when.

:max_bytes(150000):strip_icc()/accounting-40ae49d71fd0426789adc827e053780c.jpg)