Great What Are The Principal Issues In The Accounting For Ppe

To ensure the PPE is used appropriately the worker needs to be provided with information and instruction on the purpose correct use care and maintenance of the PPE.

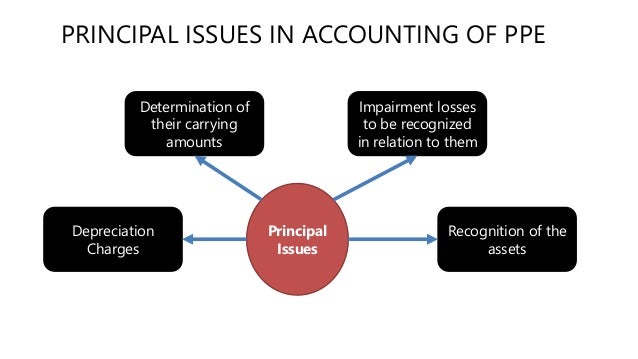

What are the principal issues in the accounting for ppe. The chapter begins by elaborating on the concepts that govern the types of costs that are properly included with. The principal issues in accounting for property plant and equipment are the recognition of the assets the determination of their carrying amounts and the depreciation charges and impairment losses to be recognised in relation to them. This is referred to as planned major maintenance under US GAAP.

UNITED NATIONS SYSTEM ACCOUNTING STANDARDS REVISION VIII Based on revision 1 ACC199520 Annex III. This will then become assumed knowledge for the SBR exam. The principalmanager of the site is responsible for the provision and purchase of appropriate PPE.

The principal issues in accounting for property plant and equipment are the recognition of the assets the determination of their carrying amounts and the depreciation charges and impairment losses to be recognised in relation to them. The Accounting Cycle unit contains chapters including Welcome to the World of Accounting Information Processing Income Measurement and The Reporting Cycle. Accounting for PPE is an important topic that features regularly in the FR exam.

PPE is the largest asset at 3745 million 3745 billion or 25 percent of total assets. Yet our assessment is that if the IASB takes its current or proposed Framework and develops accounting requirements for these items from first principles it is difficult to see what accounting the Framework would suggest. The principal issues with this standard are timing of the recognition of assets and depreciation of charges and determination of the carrying amounts The global body for professional accountants About us.

IAS 16 paragraph 43 requires that these complex assets be componentised. The principal issues in accounting for property plant and equipment are the timing of recognition of the assets the determination of their carrying amounts and. Here is a partial balance sheet for Cummins Inc a manufacturer of diesel engines commonly used in large semi-trucks.

Costs associated with routine repairs and maintenance are expensed as incurred. Chapter 10 expands upon the basic principles of accounting for property plant and equipment that have been introduced throughout earlier chapters. IPSAS 17 PPEdoc 04042008 Page 4 of 22 policy when the International Public Sector Accounting Standards Board has done further work on requirements for reporting heritage assets Accounting Policy 7-06.

_property,_plant_and_equipent_akash_1481563553_219279-4.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)